Las Vegas December 2018 Housing Stats

First, please click on the link Las Vegas December 2018 Housing Stats for the full report so you have a visual to follow along with. I will be on the first page of the report.

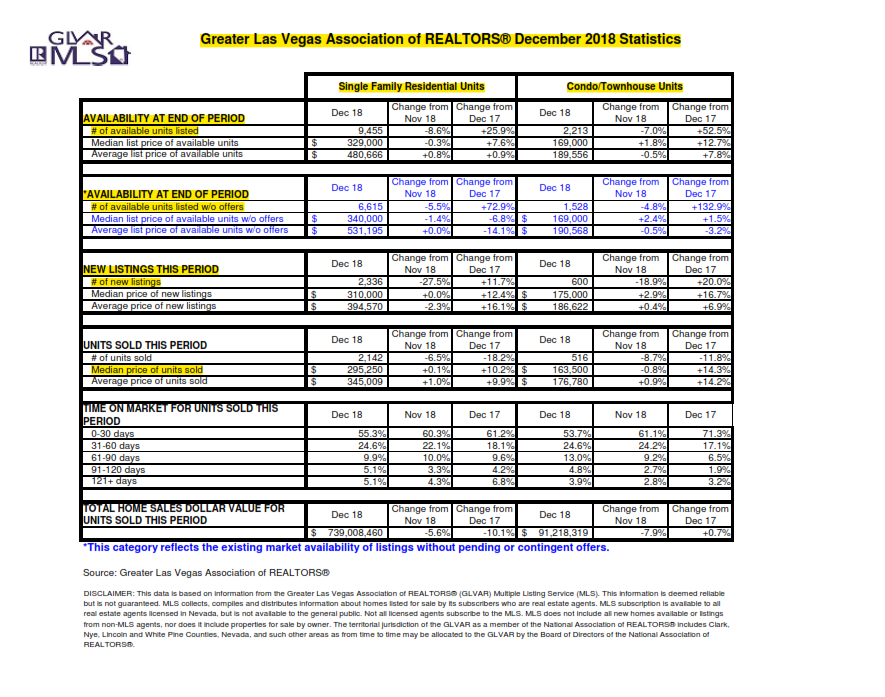

- The median price point for sold homes in December 2018 was $295,250. This is basically unchanged from the previous month, however, a 10.2% increase from Dec 2017 of $267,900.

- The number of homes sold in December 2018 was 2,142, which was a decrease of 6.5% from November 2018 and a decrease of 18.2% from December 2017.

- The number of new listings that came on the market in December 2018 was 2,336. This is down 27.5% from the previous month, however, up 11.7% from December 2017.

- The number of available homes listed without offers in December 2018 was 6,615. This is a decrease of 5.5% from November 2018 and increase of 72.9% from December 2017.

- Time on market for homes sold: 0-30 days was 55.3%, last month this number as at 60.3%. We saw an increase from 31-60 days to 24.6% and relatively unchanged from 61-90 days to 9.9%. From 91-121+ was up slightly to 5.1%.

The numbers are indicating that the Las Vegas Housing Market is continuing to show signs of a slowdown. This is evident by the decrease of homes sold in December by 6.5% from November 2019. The number of homes listed without offers was at 6,615 which is down from the previous month, but a 72.9% increase from December 2017. The median price point for the Las Vegas Market is at $295,250, which is still a 10.2% increase from December 2017. This does not mean we have to hit the panic button. We have had tremendous growth over the last several years and a slowdown for this part of the year is normal. We need to also remember that home prices are up by double digits from a year ago. GLVAR reported that properties purchased in December with cash were at 22.7%, which compares to 25.7% in December 2017. And the number of distressed sales, short sales, and foreclosures combined dropped to 2.9% from 3.6% a year ago.

(Click here or on Picture for full 8 page report.)

(Click here or on Picture for full 8 page report.)